82

HKUST 2015-2016

Annual Report

83

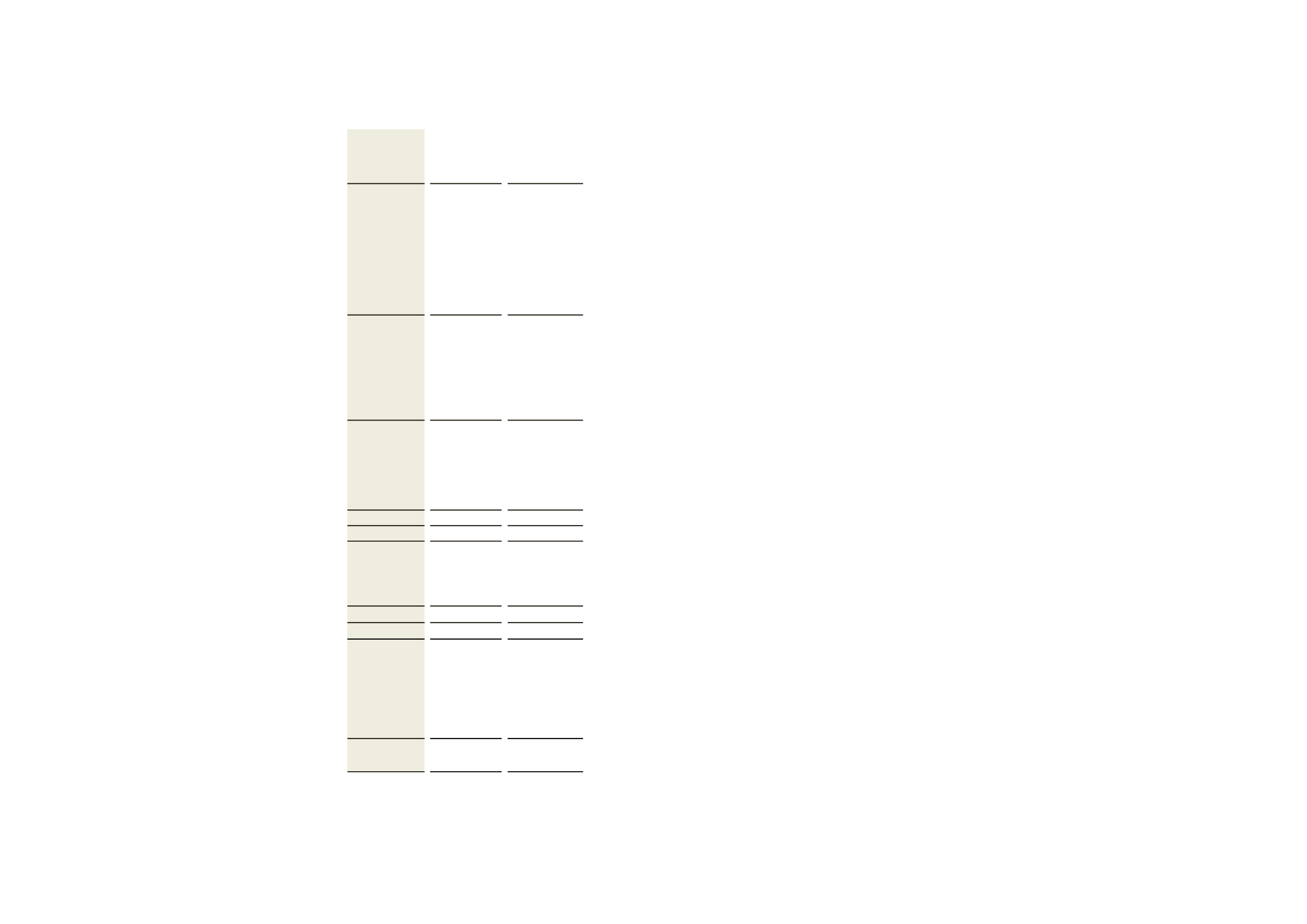

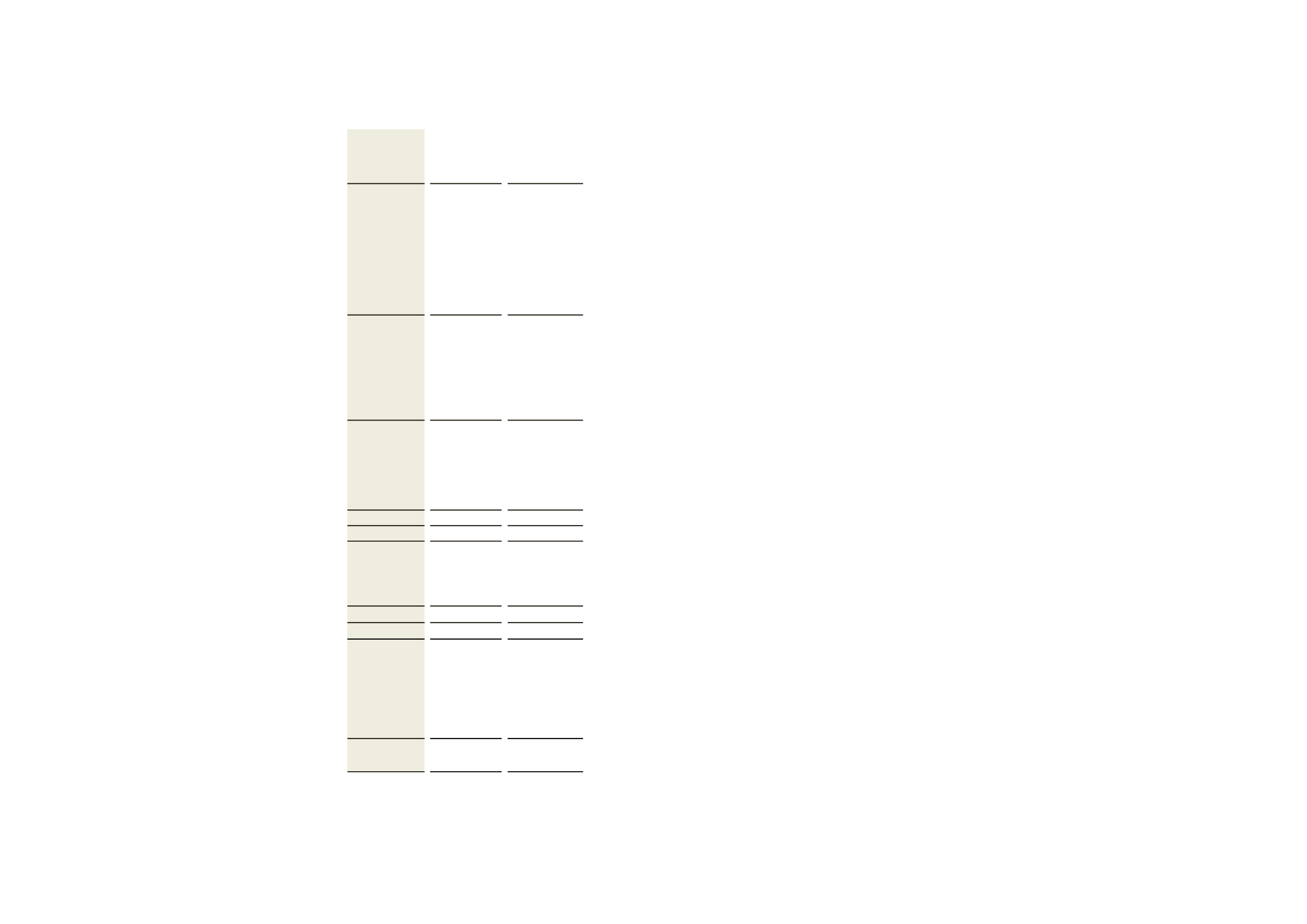

CONSOLIDATED BALANCE SHEET

As at 30 June 2016

As at 30

June 2016

$ MILLION

As at 30

June 2015

Restated

$ MILLION

As at 1

July 2014

Restated

$ MILLION

NON-CURRENT ASSETS

Property, Plant and Equipment

Intangible Assets

Held-to-Maturity Financial Assets

Available-for-Sale Financial Assets

Financial Assets at Fair Value through Profit or Loss

Interest in an Associate

Interest in a Joint Venture

4,976

7

71

18

5,275

73

0

4,813

6

71

22

4,171

64

(1)

4,551

21

108

19

4,295

66

0

10,420

9,146

9,060

CURRENT ASSETS

Held-to-Maturity Financial Assets

Inventories

Accounts Receivable and Prepayments

Bank Deposits with Original Maturity over Three Months

Cash and Cash Equivalents

0

1

187

716

888

37

0

202

1,661

687

5

1

257

1,375

787

1,792

2,587

2,425

CURRENT LIABILITIES

Accounts Payable and Accruals

Provision for Staff Benefits

Deferred Income

Tax Payable

700

165

687

1

660

163

659

1

547

154

604

2

1,553

1,483

1,307

NET CURRENT ASSETS

239

1,104

1,118

TOTAL ASSETS LESS CURRENT LIABILITIES

10,659

10,250

10,178

NON-CURRENT LIABILITIES

Provision for Staff Benefits

Deferred Capital Funds

29

3,835

22

3,730

22

3,656

3,864

3,752

3,678

NET ASSETS

6,795

6,498

6,500

UGC FUNDS

2,355

2,383

2,437

RESTRICTED FUNDS

1,177

932

914

OTHER FUNDS

3,263

3,183

3,149

TOTAL FUNDS

6,795

6,498

6,500

Note: The consolidated financial statements have been prepared in accordance with the new Statement of Recommended

Practice issued by UGC, whereby the presentation of the consolidated financial statements has changed and certain comparative

figures have been reclassified to conform with current year’s presentation. According to the required accounting standard, three

years’ figures have been presented.

APPENDIX IV: INTERNAL CONTROL AND RISK MANAGEMENT

SUMMARY OF INTERNAL CONTROL AND MEASURES

The University has developed a system of internal control

comprising both IT application based and manual controls as

well as management reporting. In order to receive assurance

that the system of internal control is effective and operating

satisfactorily, the following arrangements are in place:

(a) AControl Self-Assessment Program requires individual

units to self-review periodically the controls for which

they are responsible and communicate the results to

Management for follow-up action. This Program aims

to raise awareness of internal control throughout the

University and helps to assess the adequacy of the

University’s control processes.

(b) A consulting firm is appointed as the University’s

internal auditors to perform risk based independent

reviews on the adequacy and effectiveness of the

University’s system of internal control and recommend

areas for improvement.

(c) In addition to the statutory annual audit of the

University’s financial statements, the external auditors

also carry out an independent assurance engagement

on the University’s compliance with the guidelines,

terms and conditions imposed by the Government’s

University Grants Committee.

(d) The Audit Committee of the University agrees

a program of work for the internal auditors; receives

reports and considers control issues raised by the

internal auditors and the external auditors. The

program of audit work provides assurance that

Management has put in place and upholds an

effective internal control system.

(e) A Whistle Blowing Policy provides a safe and

protected means by which employees and students

of the University are enabled to raise concerns with

the appropriate University authorities against any

malpractice within the institution.

RISK MANAGEMENT

The University faces a number of principal risks and these are

summarized below with associated mitigation. The University

has various sources of assurance that its mitigation is effective.

(a) Academic risks:

The University strives to be a leader in education and research

and it is essential it maintains an excellent reputation in these

areas and is able to attract and retain the best global talents

including students, faculty and staff. The University has broad

and robust risk mitigation and assurance in academic areas

including the quality of its faculty and UGC’s direct review and

assessment. In particular, the University undergoes periodic

exercises such as Academic Development Planning (ADP),

Research Assessment Exercise (RAE) and Quality Assurance

Council (QAC) audits, each containing a broad range of

topics including SWOT analysis. Some of the academic

endeavors, such as research and growing parts of knowledge

transfer, services and education, are also open to international

benchmarking and peer review.

(b) Financial risks:

The University is dependent on funding from the Government

and is therefore exposed to a substantial one off reduction

in funding or sustained reduction of a significant part of its

funding. The University also derives significant income from

non-Government sources, such as its self-financed teaching

courses where it is dependent on the competiveness of its

offering both locally and internationally. The key mitigations

for funding risks are maintaining a high academic reputation

in both teaching and research and the amount of cash

reserve available. The University is also exposed to financial

risks, mainly market risks on its investments. Investment risk

is mitigated by a diversified investment strategy with acceptable

risk and return objectives approved by the Council and the

employment of external advisors and investment managers.

The Financial Statements contain further information about

financial risks and their mitigation.

(c) Health & Safety:

The University operations require the use of hazardous

materials, which can cause serious injury or death if notmanaged

correctly. The University has a comprehensive Environmental

Health & Safety (EHS) management program designed

to manage this risk. The University is a complex campus where

staff and students, live, work and study with continuous activity

to maintain and expand campus facilities. The University

has an on-campus medical facility able to respond to any

situations. All contractors on site must comply with Hong Kong

Healthy and Safety standards. University sports facilities are

suitably supervised with users receiving appropriate training

if necessary.

(d) Operational:

It is essential that the University up-holds the standards

expected of a publicly funded institution. The University has a

comprehensive code of conduct policy that all itsmembersmust

comply with. Student welfare, on and off campus, is paramount

and the University has implemented various measures to

identify and manage any concerns of students. These include

confidential access to team of professionally trained counselors

if required. TheUniversity is also aware of student sentiment on a

variety of political topics. Whilst supporting the right to freedom

of speech, the University will remind students of the need to

respect the law and that it will not tolerate any activities on

our campus which degenerate into offensive tirades, advocacy

of violence, or violence itself. The University has set itself high

academic and non-academic standards, consistent with those

of a world-class institution. Ensuring the buy-in of all staff to

performance expectations and the related change program

and maintaining staff morale during this time is a key risk. This

is mitigated by a performance incentive for academic staff

and broad staff engagement to communicate the rationale

of strategies. Despite all planning and risk management,

the University is vulnerable to a disaster whether naturally

occurring or deliberately instigated. The University has the key

components of a disaster recovery plan already developed,

including tested emergency response procedures and

restoration of back-up IT systems if necessary.

(e) Regulatory Compliance:

The University places high importance on full compliance with

all relevant requirements, whether academic, operational,

accounting, legal, tax, environmental, building code or the

specific requirements of funders. It would not knowingly breach

any requirements. The key mitigations are the employment

of seasoned and qualified staff to ensure compliance, use

of professional advisers whenever required, internal control

procedures and independent audit.

(f) Technology:

As an open community, the University is vulnerable to

unauthorized penetration of its IT networks, applications and

data with potentially serious consequence. The University has

a comprehensive cyber security policy and has implemented

a variety of security measures including a dedicated team

monitoring compliance with policy and any incidents. The

University is also undertaking changes to some of its key

administrative applications. It has invested in improved project

management capability to ensure that changes to its key

administrative systems do not cause any operational difficulty.

The University uses external service providers to perform

intensive IT audits periodically.